Just How to Buy a Home: Important Actions for First-Time Buyers

Navigating the journey of acquiring a home for the very first time can be both a thrilling and difficult experience (Houses To Buy Melbourne). To make sure a successful purchase, newbie purchasers should systematically assess their economic situation, check out financing alternatives, and carry out extensive market research study. Understanding these foundational actions is crucial to making notified choices that line up with one's economic and individual goals. As we explore these necessary stages, it comes to be noticeable that each action provides its own challenges and chances, prompting additional examination of just how to successfully maneuver through this complex procedure.

Examine Your Economic Situation

Prior to embarking on the trip of homeownership, it is critical to perform a thorough financial evaluation. This action serves as the structure for identifying your readiness to buy a home.

Furthermore, examine your savings to determine exactly how much you can allot for a down repayment and closing expenses. A healthy cost savings account not just help in safeguarding favorable funding options however also provides a safety web for unforeseen expenses post-purchase.

It is similarly vital to examine your credit history, as this number significantly impacts your home loan qualification and rates of interest. Acquire a credit rating record and fix any kind of mistakes while being mindful of outstanding financial debts that might impede your financial standing.

Lastly, consider your long-lasting economic goals and just how homeownership lines up with them. Buy House In Melbourne. By carefully analyzing these aspects, you will certainly acquire a clearer understanding of your economic scenario, placing on your own for an extra critical and educated technique to buying a home

Explore Financing Options

How can you browse the wide variety of funding options offered for purchasing a home? Understanding your choices is crucial for making educated decisions that align with your monetary situation. The most usual financing alternatives include standard loans, FHA car loans, VA loans, and USDA finances.

Conventional finances typically require a greater credit report rating and a down payment of at least 20%, however they frequently include reduced interest rates. FHA loans, guaranteed by the Federal Real estate Management, accommodate novice purchasers with reduced credit rating and permit down settlements as reduced as 3.5%. VA finances, available to professionals and energetic army workers, use favorable terms, consisting of no down payment and no personal home loan insurance (PMI) Likewise, USDA lendings are created for rural buyers and offer 100% financing for eligible candidates.

Furthermore, it is necessary to consider adjustable-rate versus fixed-rate home loans (ARMs) Fixed-rate home loans keep the exact same rate of interest price throughout the car loan term, while ARMs may start with lower rates that change in time. Research numerous loan providers to compare interest terms, fees, and rates to discover the most effective suitable for your economic goals.

Research the Housing Market

Regularly investigating the real estate market is essential for potential property buyers to make informed decisions. Understanding present market patterns, residential property worths, and community characteristics encourages purchasers to recognize suitable residential or commercial properties and work out properly.

Begin by analyzing regional market records, which provide understandings into typical home costs, supply levels, and the rate of sales. These records can indicate whether the market prefers vendors or purchasers, influencing your purchasing strategy. Furthermore, acquaint yourself with historic price fads in your target areas; this expertise can help you assess possible future worths and prevent paying too much.

Engage with trustworthy online platforms that aggregate realty listings and give extensive market data. Focus on factors such as days on market and rate reductions, as these can signal market changes.

Additionally, take into consideration linking with neighborhood genuine estate representatives that can supply beneficial insights and proficiency on certain neighborhoods. They can supply context about neighborhood services, school areas, and future growths, enhancing your understanding of the location.

Begin House Searching

Having actually gathered insights from the real estate market, the next action is to start house hunting successfully. Beginning by recognizing visit this site your priorities in a home, such as area, dimension, services, and proximity to function or schools. Creating a list can aid streamline your search and keep your goals in focus.

Use online platforms and property applications to search listings that satisfy your criteria. Focus on residential property information, consisting of images, summaries, and area statistics. Organizing viewings is important; routine sees to homes that ignite your interest and be prepared to evaluate each home seriously.

In enhancement to on the internet resources, teaming up with a certified property agent can provide important understandings and access to listings not commonly marketed. A representative can assist navigate the nuances of your recommended areas and facilitate interaction with vendors.

The excellent home might not align specifically with your preliminary assumptions. By my company being proactive and methodical, you can make enlightened decisions throughout this amazing phase of home acquiring.

Make an Offer and Close

Begin by discussing your offer strategy with your genuine click here for more estate agent, who can supply beneficial insights based on market conditions and similar sales. Take into consideration elements such as the home's asking cost, its problem, and just how long it has actually been on the market.

Once your offer is submitted, the seller might approve, decline, or counter your proposal. Be gotten ready for settlements and continue to be flexible to reach a mutually reasonable cost. If your offer is approved, you will certainly continue to the closing stage, which involves a number of essential steps.

Verdict

To conclude, browsing the home-buying procedure as a new purchaser demands a methodical technique. Evaluating financial readiness, exploring ideal financing options, and looking into the real estate market are essential steps that prepared for successful house searching. Making notified choices throughout the offer and closing phases is crucial to ensure a desirable transaction. By adhering to these essential actions, newbie purchasers can achieve their objective of homeownership with confidence and quality.

To make sure a successful purchase, new purchasers have to systematically analyze their financial situation, explore financing alternatives, and conduct thorough market research study.Beginning by evaluating local market records, which provide insights right into ordinary home prices, stock degrees, and the rate of sales.Having collected understandings from the real estate market, the next step is to start residence hunting efficiently. Take into consideration factors such as the home's asking cost, its problem, and just how long it has actually been on the market. Assessing monetary preparedness, discovering ideal funding options, and looking into the real estate market are fundamental steps that lay the groundwork for successful home searching.

Yasmine Bleeth Then & Now!

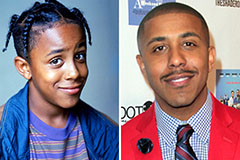

Yasmine Bleeth Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! David Faustino Then & Now!

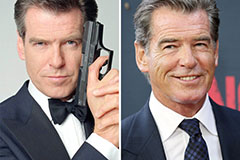

David Faustino Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!